For every cheque is old having encashment to possess a certain time. Banking companies dollars new cheques so they have the EMI payment promptly. It is very important guarantee that the financial institution membership away from which currency might possibly be debited to cover home loan EMI should have adequate financing for debit that occurs. In the event your cheque bounces and/or vehicle-debit cannot read, there’ll be a put-off inside the commission which often leads to punishment charges.

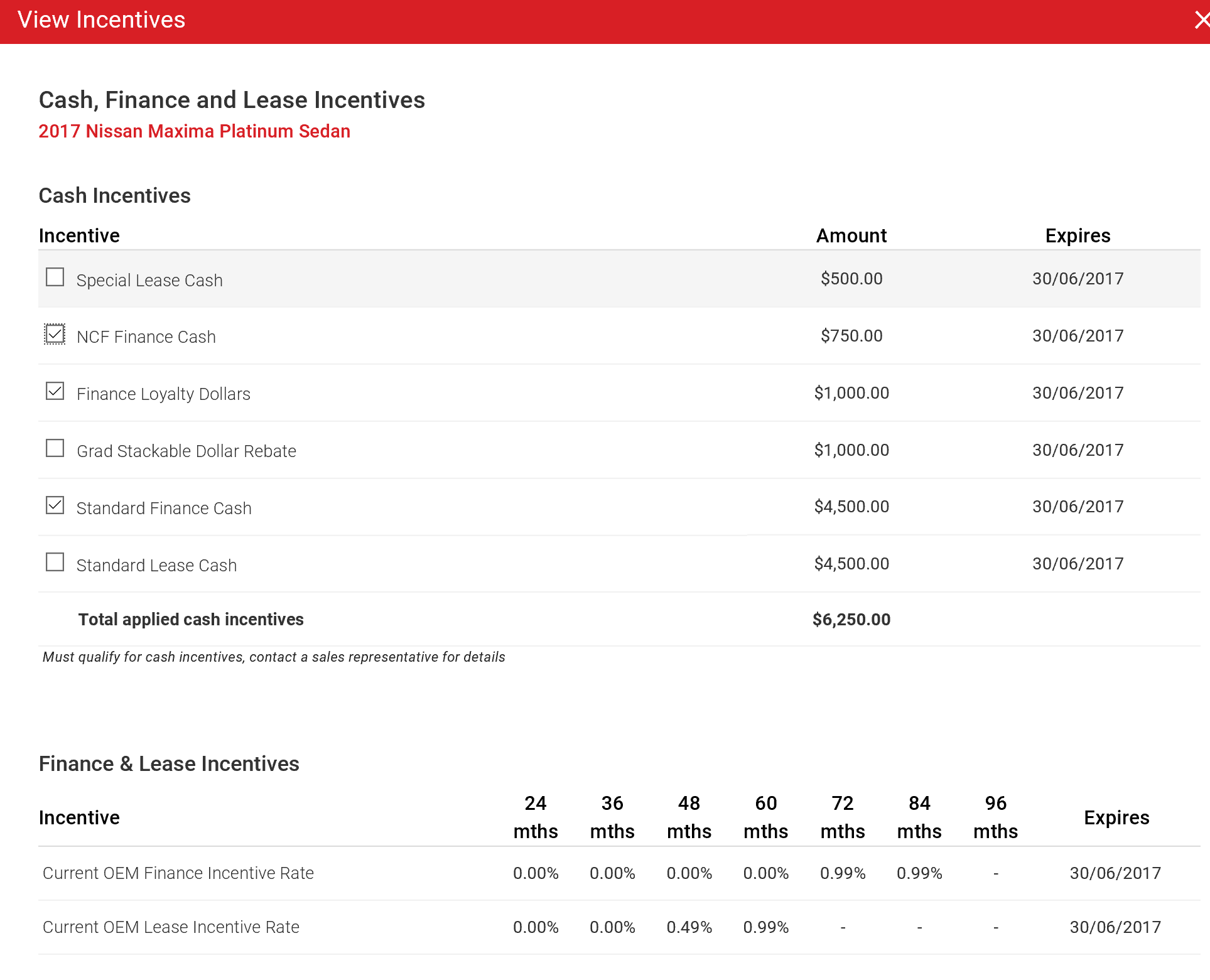

New offered the mortgage tenure, the reduced the fresh EMI and the other way around. Use the home loan EMI calculator to obtain the EMI so you can be distributed a variety of financing tenures. You will find three input areas regarding EMI calculator prominent amount, loan period and you can interest rate. Brand new calculator usually calculate the newest EMI count in different credit problems in line https://clickcashadvance.com/personal-loans-tn/nashville/ with the type in offered. The fresh candidate may get acquainted with the brand new EMI number to have additional financing tenures in one prominent count. For-instance, if you have enter in the latest period to be 5 years very first, you can transform it to ten, 15 and you can 2 decades. The home loan applicant is ount he/she is capable spend conveniently day-on-week. The fresh new candidate can choose suitable mortgage period following this get it done with the mortgage EMI calculator.

Obtain an understanding of your house mortgage EMI prior to getting an effective mortgage

- Develop a monthly funds

List monthly expenses in place of monthly income. You will need to be able to save one sum of money after bookkeeping having typical monthly costs. Thorough analysis of all existing expenditures will reveal some expenses one to you certainly can do out with. Even some currency that is saved week-on-few days turns out to be an enormous sum of money at the the termination of the year.

Obtain an insight into the home financing EMI prior to getting an effective financial

- Evaluate latest profit

Unless of course our home mortgage applicant understands their/her current economical situation, this is simply not you can easily to improve they. Writing out all of the expenses is an excellent place to start the fresh review out of funds. Include all the costs in spite of how superficial they may seem. All Rupee counts regarding managing currency. The theory is to make certain that the expense is located at at least as there are a cost savings funds.

Gain an understanding of our home mortgage EMI before getting a great home loan

- Score an insurance safety

Health insurance and life insurance policies is the most significant insurance rates covers you to one have to have. Aside from that it, any asset that is off extreme worthy of and that will pricing large sums when in resolve are insured. As an example, homeowners insurance and you may automobile insurance. That have property insured gives a reassurance when one knows that their/this lady head economic liability is bound.

Obtain an understanding of the home financing EMI before getting an excellent home loan

- Carry out an emergency finance

Which have an emergency financing to-fall right back towards the aids in preventing financial obligation. Having an urgent situation financing decreases one’s liability to help you borrow regarding banks and you may NBFCs hence cutting dependency towards the borrowing from the bank. Along with, having an urgent situation loans will bring on it new comfort to be capable perform tough points without worrying regarding the monetary factor.

You need to decide for a loan amount which covers the expenses under consideration. Pick high loan amount as long as its absolutely necessary so are there no situations through the installment. The low the main lent, the reduced will be the EMIs.

Relate to new dining table less than to get an understanding of EMIs for several principal quantity and you may financing tenures. This will be helpful in ount and mortgage period that one can choose according to research by the EMIs.