Likewise, FHA Financing generally promote most useful costs than simply old-fashioned fund to own individuals having reduced fico scores

Our history article browsed U.S. Agencies from Agriculture (USDA) Finance, plus loan standards, identifying characteristics from a qualified rural area, benefits, the borrowed funds processes, and Guaranteed versus Lead USDA Financing. That it few days the audience is evaluating Federal Housing Administration (FHA) Funds and you may USDA Financing to assist potential customers determine if one or both possibilities fit their requirements.

- Income demands none

- Credit history and you may background it hinges on the lender, many undertake as little as 580; FHA recommendations declare that insufficient credit score is not a legitimate need so you can refute a loan

- Geographical & possessions standards there are no geographic conditions, but functions was limited by manager-filled residential property

- A position have to have steady earnings and a job reputation for two successive many years most of the time, nevertheless will likely be waived in certain situations; a page of reasons required when the discover holes in a job one month or offered

- Mortgage form of 30-seasons fixed financial, 15-12 months fixed financial, otherwise varying-price home loan

- Money requirements earnings restrictions are different with regards to the area, nevertheless family income restriction is usually $91,900 getting children all the way to cuatro some body and you can $121,3 hundred for five-8 somebody. All round rule is the fact your loved ones income can not be fifteen% over the median money where you live. Brand new borrower should features a reasonable obligations-to-earnings proportion

- Credit rating and you will record really lenders need a credit history with a minimum of 640 and a clean credit score

- Geographical & possessions standards it ought to be just one-home during the a qualified city and must be taken just like the your primary house

- Work must have regular income and you will a position history of a couple of consecutive many years in most cases; self-employment is approved

- Financing kind of 30-year fixed financial

There are a few secret benefits of a great USDA Mortgage

Of many lenders encourage a credit history as low as 580, and tend to be blocked of doubt inspect site that loan on account of a beneficial shortage of credit rating. An additional benefit is the low-down percentage tolerance, as numerous lenders only need an advance payment away from 3.5 per cent.

You will find some drawbacks to help you FHA Money. With respect to the region you live in, there are certain mortgage restrictions set up, that have $420,680 being the limit loan amount in most parts. Other disadvantage would be the fact of several apartments are not accepted, particularly the groups one to run out of economic information or run on an excellent minimal otherwise troubled finances. On the other hand, personal home loan insurance (PMI) cannot be cancelled if you don’t place about 10 percent off. If so, it may be cancelled immediately after eleven years.

The biggest grounds for many is the fact no down-payment are you’ll need for people that meet the requirements. It opens up the doorway to homeownership for people who have been blocked of the a good 5 percent so you’re able to 20% down payment. Almost every other pros are competitive interest rates, reasonable monthly mortgage insurance, and flexible borrowing from the bank criteria.

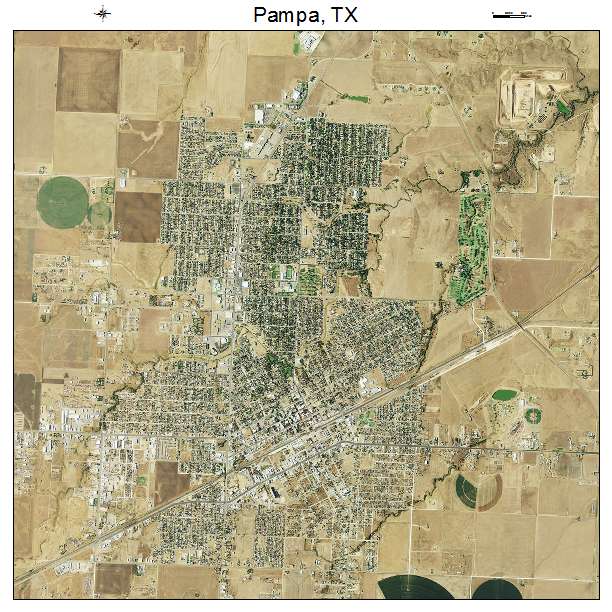

Geographical limits is actually a button disadvantage to USDA Fund. Eligible elements should be outlying inside profile, enjoys a populace less than thirty five,100, and lack enough financial borrowing for lower- and average-money family. There are even income restrictions, which are typically $91,900 to own children of up to 4 individuals and you can $121,three hundred for 5-8 someone. The entire code would be the fact your loved ones money can not be 15% above the average income in your geographical area. In addition, borrowers try limited by solitary-loved ones house.

Which loan is best suited for your own personal scenario? For those who still have inquiries once examining the needs additionally the pros and cons of any sort of financing, Mlend is here so you can ideal learn the choices.