What’s a home guarantee line of credit? And you may, more importantly, how do you choose the best you to definitely from the proper lender? These are preferred resident concerns, and you may – thankfully – they show up which have effortless responses.

A home guarantee personal line of credit, otherwise HELOC, is a lot like many types of borrowing from the bank, including house guarantee fund. But alternatively of getting a lump sum payment as with a great home equity financing, no bank account loans Towner CO homeowners receive a personal line of credit having good HELOC.

Preferred aspects of taking an effective HELOC become buying home improvements, debt consolidation reduction, a unique vehicle or other costs. But also for many borrowers, one of the main factors is that they you prefer currency for a crisis or a direct, important costs. And because financial liberty is paramount to addressing unplanned will set you back, TD Bank helps make that it a cornerstone of its HELOC.

But regardless of if putting on monetary independency is very important, finding out how an effective HELOC functions is vital. Possibly the key section of a good HELOC, when it comes to monetary effect, is the difference between the latest mark months together with cost period.

Having an excellent TD Financial HELOC, the new draw period ‘s the period of time if you’re able to draw on the personal line of credit and you will pay just interest. Meanwhile, the payment months starts at the conclusion of the new mark months. During this time, you only pay straight back any amount of money you borrowed in draw period and you can desire.

After your own HELOC’s draw period, you are not limited by merely settling the fresh new HELOC – it is possible to re-finance they. If you are torn anywhere between settling your loan versus refinancing, refinancing to the another TD Financial HELOC might be the wiser selection – specifically if you possess constant systems or costs you should loans.

TD Lender HELOC Remark

TD Lender shines with respect to household guarantee financing and you can HELOCs, offering customers and you may property owners inside fifteen says and you will Arizona, DC, competitive cost and a few masters never available at competing loan providers.

Besides boasting reasonable pricing toward household guarantee credit lines, TD Financial now offers fixed-rate HELOC choices in addition to variable-rate money. And additionally, one another TD Bank’s fixed and varying prices stack up better that have equivalent lenders.

TD Financial as well as lets customers to take out an excellent HELOC to the the top household, 2nd home or money spent. Bear in mind, but not, you to definitely certain TD Lender household security lines of credit you will been that have important charges, together with a good $99 origination commission and you will an effective $fifty annual percentage.

Nevertheless, because of the independence and lower prices, an excellent TD Financial HELOC turns out to be a beneficial tool having many residents with assorted financial objectives.

TD Financial HELOC Pros

An effective TD Financial HELOC boasts a number of positive possess. One of the most-cited advantages: its liberty. To put it differently, you can make use of which HELOC since you need they – and many different objectives.

Instance, homeowners have a tendency to fool around with HELOCs just for household home improvements. TD Bank’s HELOCs can be used for a good amount of household update plans, along with big home improvements and also time-productive enhancements. And you may, all of these domestic home improvements pays off big-time down the latest range, as they boost your residence’s worth.

But you’re not simply for just family renovations along with your TD Bank HELOC. You are able to use it in order to combine the debt – and perhaps deduct the interest been taxation time – otherwise generate a major pick, such as for instance a motor vehicle, degree otherwise a holiday. Assuming a crisis or other unplanned costs pop-up, an excellent TD Bank HELOC can give you usage of the bucks you’ll need.

TD Bank’s repaired-rate options are an excellent advantage. Getting a HELOC which have a varying price gives you the possibility to protected the rates and you will covers you against the results regarding ascending primary pricing, affecting varying rates to your household guarantee personal lines of credit.

- Discover an effective $25,000 minimal line required, but there is however no minimum mark requirement.

- You can buy a beneficial 0.25 % interest rate discount for those who have a good TD Financial private family savings.

- Which have a fixed-speed choice, you can favor a predetermined price on your whole collection of borrowing from the bank – or perhaps a portion of it.

The way to get a great TD Financial HELOC Now

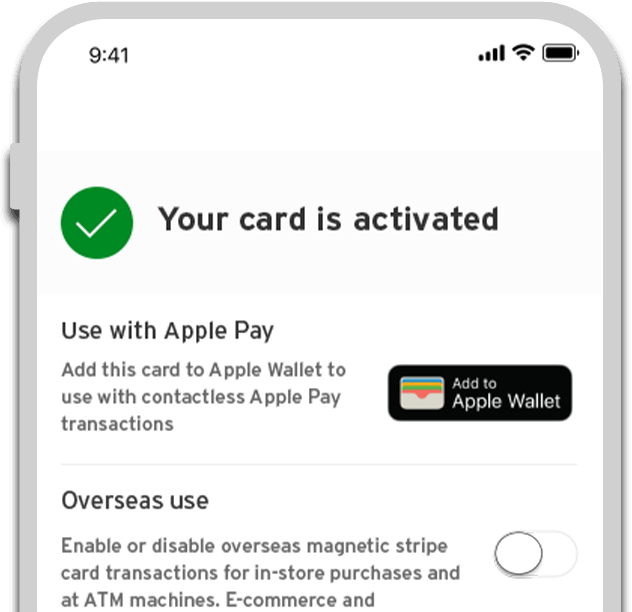

You are able to make an application for a great TD Lender HELOC online from the visiting the family equity credit line webpage to the TD Bank’s webpages. On the internet site, research HELOC costs centered on the area code. There are also HELOC costs toward an initial house, next domestic and you will investment property.

In order to implement on line, simply click Apply Today. You’re going to be brought so you can TD Bank’s household equity app techniques. Right here, you are drawn as a result of 7 simple steps, each of them approaching extremely important information about your financial condition, including:

- Loan recommendations

- Private information

- Money and you can a career

- Personal internet value

- Possessions suggestions

- Monthly costs

When you yourself have inquiries or need help inside the on the internet software procedure, you can label TD Bank’s Economic Options Group during the 1-800-822-6761.

If you ought to boost your house’s really worth compliment of wise renovations or combine and have of a financial obligation smaller, you will find an effective HELOC that suits your unique economic demands – everything you need to carry out is a little piece of look. And you may due to the monetary independence a beneficial TD Financial HELOC also offers, this can be the solution you’ve been interested in.