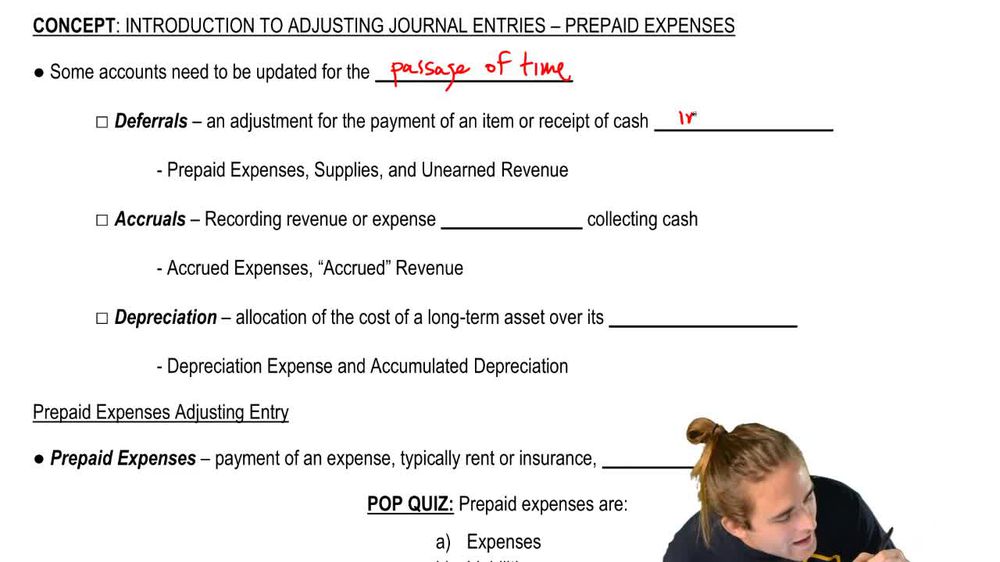

To acquire a vehicle is a huge connection due to people large costs, however it is a requirement for the majority of. After you fundamentally choose the selection of buying a motor vehicle this new or utilized you’ve got several chief selection regarding paying the price; you might pay bucks-on-hand, otherwise buy it that have an auto loan also known as a beneficial hire-purchase financing).

However when it comes to taking a car loan, of several (specifically first-time consumers!) dont fully understand the way it works. So, to really make it more relaxing for someone to understand what auto loans are all about, the following is an elementary publication on auto loans.

What is a car loan?

A car loan in the Malaysia is a kind of financing you to definitely are pulled of the a single towards the sole reasoning of purchasing an automible. By firmly taking right up that it financing, this individual try tied down seriously to a proper composed arrangement where this new debtor (car visitors) is actually in financial trouble to spend the mortgage number as well as appeal for the financial (banking companies, economic agents, etc) more a specified time period. In case the individual does not take action in said period of your time, this may improve automobile becoming repossessed because of the bank.

A car loan, just like any other mortgage can help you economically once you do not have adequate. Unless you features loads of bucks under your support to invest in your new vehicles, financing makes it possible to pick a vehicle which you dont pay for with just dollars.

Understand Such Earliest Auto loans Words Basic

not, below are a few first car finance conditions (that we also have listed above) knowing in advance of we diving better on this topic.

- Interest : This is the total cost away from taking right out financing it is the price you have to pay so you can borrow cash regarding loan places Steele bank. This will depend towards legs rate which is provided by the fresh financial, that go up and down according to the state’s economy.

- Downpayment : Brand new upfront fee on the automobile which takes care of an element of the costs., It certainly is, 10 percent% of one’s total price for new autos and you may 20 percent% to own made use of autos.

- Margin away from Funds : The fresh new proportion of your own vehicle’s rates that bank tend to lend for your requirements. Essentially, it makes reference to how much the financial institution might possibly be financial support or forking away for the car’s cost.

- Financing Several months : The total amount of months otherwise /years delivered to pay back your loan.

- Payment : The amount that you need to spend month-to-month with the financial to pay off regarding your loan.

- Guarantor : A person who is bound legally to settle your loan when the you aren’t able to perform it.

- Repossession: The lending company (bank) eliminates the vehicle out-of a debtor in the event that latter goes wrong to service the car financing payments in 2 successive months.

Therefore, exactly what are the Data files Necessary for a car loan?

I have outlined the entire records that you’re going to you prefer getting a car loan software. However, just remember that , there could be additional data files called for to suit your loan application that certain banking companies might need.

How come a car loan work with Malaysia?

Generally, there are two main style of car loans and also the rate of interest can vary because hinges on the beds base rates, the lending company you choose and if you are providing a separate auto or a good car or truck.

Several chief form of car and truck loans

Finance companies generally offer you a great margin of finance up to 90 percent, since the rest is recognized as your own advance payment. But if you are able to afford they, using increased down payment commonly lessen your dominating amount borrowed and you can appeal.

Another factor that you will apply to their fees and you will notice ‘s the loan several months. Into the Malaysia, the maximum repayment several months for a car loan was 9 decades. The fresh stretched you stretch the latest installment months, the brand new faster installment matter you can pay four weeks, regardless of if at the cost of running into a great deal more desire along side much time focus on.

Example: You are taking right up a good RM 70,one hundred thousand car loan with an interest rates of step three.5 percent. This is the way much desire is generally accumulated, and your month-to-month installment.

Manage take note you to definitely auto loans which have a margin off financing out of completely% manage can be found. Complete mortgage money is just offered only because of the not many loan providers and also for certain consumers such as first-time vehicle people.

Cost and Interest

Why don’t we circle back into a similar analogy where your vehicle mortgage was at RM70,100 with an interest price out-of step 3.5 per cent and a good five-seasons loan several months. Information on how the full desire, monthly attract and you can month-to-month payment could be determined according to the formula a lot more than.

Car loans calculator

Auto loan rates of interest in Malaysia disagree considering different facets which includes the company, design, the newest car’s age (the brand new otherwise utilized), the newest economy of your own borrower, the complete loan amount, this new fees months, while the borrower.

Very, it is usually best if you make evaluations anywhere between numerous court and certified loan providers prior to deciding toward a car loan. The best way to accomplish that is through an online car loans calculator . There is as well as made anything easier for you to compare the eye rates* ranging from nine significant banking companies into the Malaysia to help you help make your choices intelligently.